Transformational Investment: Converting Global Systemic Risks into Sustainable Returns, published by the World Economic Forum in collaboration with Mercer, addresses some of the long-term, global systemic risks facing our economy, society and the planet – and the need to do so has arguably never been stronger. The institutional investment community has the collective power to champion long-term thinking, to constructively tackle complicated problems, and to bring positive change – all while pursuing attractive risk-adjusted investment returns.

This report represents an important step on the journey to effective collective action by the institutional asset owner community and the financial services industry. The evolving set of long-term risks and challenges – accompanied by opportunities for transformational investment – are not easily captured within conventional investment and risk management frameworks. These risks share characteristics including:

- Long time horizon with widespread, sometimes global, impacts,

- Lack of accepted standards for measurement, and

- Potential for adverse impact on:

- Ability of long-term investors to achieve their objectives; and/or

- Economic stability of the funding entity.

- Ability of long-term investors to achieve their objectives; and/or

Through interactive sessions and development of illustrative case studies with sophisticated investors around the globe, this report has been developed to support efforts to allocate capital to positively impact our planet and society while seeking strong risk-adjusted investment returns. Specifically, the report documents a tested pathway for long-term investors to convert systemic risk uncertainty into sustainable investment opportunities.

Identifies six global systemic risks

That affect global asset owners, (additionally, pandemic risk with the specific example of COVID-19 is addressed in a paper supplementing this report)1,

Global Systemic Risks

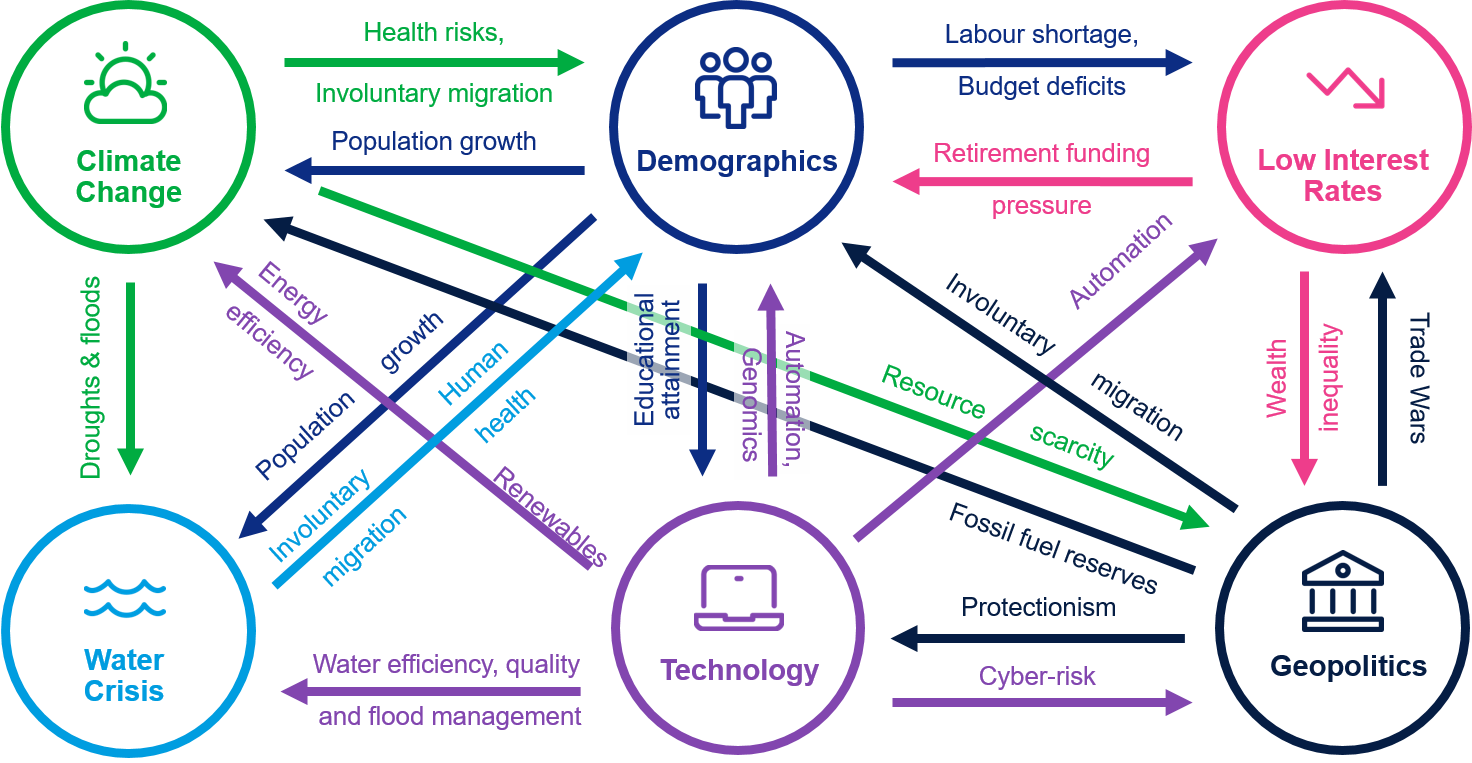

The World Economic Forum Global Risks Report 20202 highlights the most significant risks faced by the world today. From this report, we focus on six key global systemic risks identified as most relevant to long-term investors. These six risks have varying importance to different asset owners based upon each fund’s objectives, policy mandates, capital adequacy and governing structures.

| Climate change | Ability for governments and businesses to address climate change, protect populations and adapt. |

|

| Water security | Exposure to declining quality or quantity of fresh water, affecting human health or economic activity. |

|

| Geopolitical stability | Implications of rising global inequality, populism, protectionism, interstate conflict and threats to free trade. |

|

| Technological evolution | Risks and opportunity associated with technological advances, inadequate infrastructure and networks, cyberattacks. |

|

| Demographic shifts | Implications of ageing populations globally, demographic imbalances between rapidly ageing regions and those entering demographic transition, and impact of migration. |

|

| Low and negative real long-term interest rates | Implications on monetary policy and return requirements for investors and stakeholders of sustained near zero or negative real long-term interest rates. |

The complicated interrelationship of these risks calls for a holistic approach to strategy development and risk management – one that is well suited for long-term investors such as sovereign wealth funds, insurers and other large asset owners. Their multi-decade time horizon positions them to look further into the future than typical asset managers when making investment decisions, considering the impacts of risks and opportunities and leveraging their capabilities to uncover, catalyze and manage investments that achieve their transformational objectives and policy mandates.

Summarizes case study insights from large asset owners

- The Guardians of New Zealand Superannuation, which manages the NZ Super Fund, concluded that ignoring climate change in investment decisions constitutes taking ‘undue risk’.

- British Columbia Investments (BCI) has identified water risk as a top engagement issue.

- Temasek evaluates the impact of geopolitical risk and the potential risk-adjusted returns to their portfolio through various stress scenarios.

- Mubadala responds to technological evolution through its investment strategy, internal processes and human capital initiatives across its organization.

- Sunsuper consider demographics as a key input into the Fund’s investment objectives.

- The persistence of low and negative interest rates has benefited the Ireland Strategic Investment Fund as its benchmark commercial return has reduced through time. In addition, ISIF has taken a number of portfolio actions to address portfolio implications.

Download the full report to read about the actions and conclusions reached by leading investors, illustrating the unique approaches to systemic risks, often achieved through collaboration with other global stakeholders.

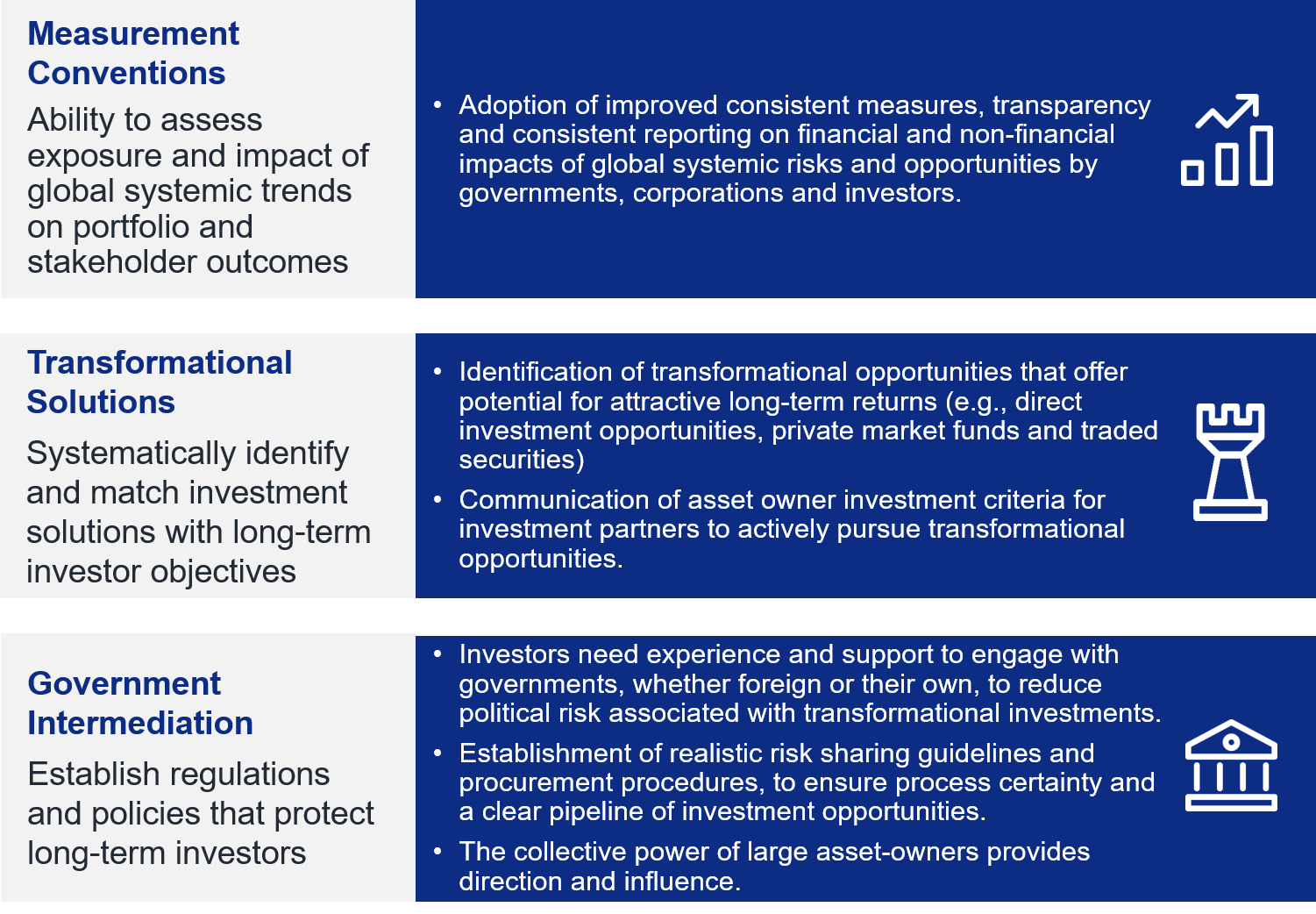

We believe the capacity of universal shareholders to pursue transformational investments while capturing attractive risk-adjusted investment returns is critical to further progress. To enable progress, robust governance is needed. The potential benefits of the six-step roadmap include:

- Pathways for investors aspiring to become market leading in addressing global systemic risks

- Discipline in achieving holistic management and addressing global systemic risks

- Collaboration to tackle and adapt to challenges:

- Identifying stakeholders with aligned interests

- Developing encompassing approaches that solve for risk interdependencies.

- Monitoring through measures that establish foundational understanding of risk impact

While this report is based upon casework done in 2019 predating the global pandemic, the investment governance considerations can also be applied to the COVID-19 market experience. Mercer has addressed this in a supplemental work using the same governance and decision-making framework, Navigating a pandemic-driven market crisis: Investment governance and strategy. This paper evaluates how large, diversified asset owners are applying their governance policies to the current pandemic-driven crisis associated with COVID-19.